Mahatma Gandhi National Rural Employment Guarantee Scheme has been allocated Rs. 38,500 crore ahead of important elections in five states this year.

Modi ji spent the first 2 years mocking the Congress Party’s focus on farmers, MNREGA, Rural dev & social spending. Now mere rhetoric, without vision or action, will fool neither farmers nor the poor of this country.

#Budget2016 lacks both vision & conviction.A list of new promises without any account of the failure of tall promises made in last 2 budgets!

Rahul Gandhi, Congress Vice-President.

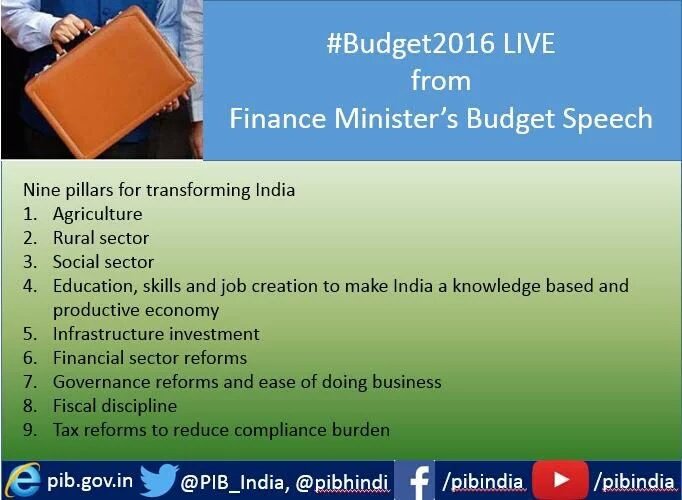

Finance Minister Arun Jaitley listed ‘nine pillars’ including tax reforms, promoting ease of doing business and ensuring fiscal discipline, that will transform India.

Unveiling the Budget 2016-17, he said the pillars also include emphasis on governance reforms.

The other pillars, he added, include focus on agriculture and rural areas with a view to doubling farm income by 2022.

Besides, he said, government will lay greater emphasis on social sectors, education and skill building and job creation for building a knowledge based and productive economy.

The government, Jaitley said, will also focus on infrastructure investment, financial sector reforms, fiscal discipline and tax reforms to reduce compliance burden.

Key announcements in his budget speech includes opening up of 62 new navodaya vidyalayas.

The Govt is focusing on the agriculture sector with many implements cheaper for the farmers.

Prices for Fertilisers for farmers have been lowered.

Electric motor pump, cold storage and refrigerated containers have been made cheaper for farmers so that they can send their products to the common man with ease.

A huge rebate for flats in the size of 30 upto 30 sq metres under Sabke Liye Awaas Scheme while contruction materials in home building would be cheaper.

Also, dialysis and artificial body parts, things used by Divyangs would be cheaper.

Government has given rebate in prices of sanitary pads, napkins, leading to their cheaper price.

While people will get rebate in some insurance policies related to NPS.

Reading-writing related paper, paperboard and newsprint would become cheaper.

Computer parts, microwave, set-top box, broadband router, electric items, CCTV, mobile battery solar lamp, wing energy equipments would be cheaper.

Talking about the other aspect of the Budget, Luxury and comfortable items would be dearer.

One has to shell more for buying Car, Luxury car, SUV.

Pan and Tobacco products like cigarette, Bidi, Pan Masala and Gutkha would be costlier.

Kaju, Packaged beverage, mineral water would also cost more.

Mobile phones, branded readymade clothes worth over one thousand rupees and footwear would now cost more.

Rubber products would cost more.

Travel by ropeway, cable-car, aerial tram would be costlier.

Artificial jewellery, aluminium products, industrial solar water heater, solar tempered glass to be costlier.

Drawing and design making for any plan would be costlier.

Charger, battery, adaptor, telecom equipments, optical fibre, laptop and desktop computer, tablet, mobile phone prices to go up.

Imported defence equipments and road construction equipment to be costlier.

Finance Minister Arun Jaitley spelt out the Agenda for transformative measures for India that will be undertaken based on 9 pillars.

Jaitley said growth of GDP has accelerated to 7.6%

Finance Minister said that Forex Reserves have reached their highest mark at $350 billion.

Arun Jaitley spelt out schemes envisaged for the welfare of farmers, women and weaker sections of society.

A dedicated irrigation fund worth Rs 20,000 crore to be set up under NABARD.

Arun Jaitley spelt out schemes envisaged for the welfare of farmers, women and weaker sections of society.

Arun Jaitley announced three specific initiatives for effective procurement to ensure MSP reaches farmers all across the country.

Tax

Infrastructure and agriculture cess to be levied.

Excise duty raised from 10 to 15 per cent on tobacco products other than beedis

1 per cent service charge on purchase of luxury cars over Rs. 10 lakh and in-cash purchase of goods and services over Rs. 2 lakh.

SUVs, Luxury cars to be more expensive. 4% high capacity tax for SUVs.

Companies with revenue less than Rs 5 crore to be taxed at 29% plus surcharge

Limited tax compliance window from Jun 1 – Sep 30 for declaring undisclosed income at 45% incl. surcharge and penalties

Excise 1 per cent imposed on articles of jewellery, excluding silver.

0.5 per cent Krishi Kalyan Cess to be levied on all services.

Pollution cess of 1 per cent on small petrol, LPG and CNG cars; 2.5 per cent on diesel cars of certain specifications; 4 per cent on higher-end models.

Dividend in excess of Rs. 10 lakh per annum to be taxed at additional 10 per cent.

Personal Finance

No changes have been made to existing income tax slabs

Rs 1,000 crore allocated for new EPF (Employees’ Provident Fund) scheme

Govt. will pay EPF contribution of 8.33% for all new employees for first three years

Deduction for rent paid will be raised from Rs 20,000 to Rs 60,000 to benefit those living in rented houses.

Additional exemption of Rs. 50,000 for housing loans up to Rs. 35 lakh, provided cost of house is not above Rs. 50 lakh.

Service tax exempted for housing construction of houses less than 60 sq. m

15 per cent surcharge on income above Rs. 1 crore

Social

Rs. 38,500 crore for Mahtma Gandhi MGNREGA for 2016-17

Swacch Bharat Abhiyan allocated Rs.9,500 crores.

Hub to support SC/ST entrpreneurs

Government is launching a new initiative to provide cooking gas to BPL families with state support.

LPG connections to be provided under the name of women members of family: Rs 2000 crore allocated for 5 years for BPL families.

2.87 lakh crore grants to gram panchayats and municipalities – a quantum jump of 228%.

300 urban clusters to be set up under Shyama Prasad Mukherji Rurban Mission

Four schemes for animal welfare.

Health

2.2 lakh renal patients added every year in India. Basic dialysis equipment gets some relief.

A new health protection scheme for health cover upto 1 lakh per family.

National Dialysis Service Prog with funds thru PPP mode to provide dialysis at all district hospitals.

Senior citizens will get additional healthcare cover of Rs 30,000 under the new scheme

PM Jan Aushadhi Yojana to be strengthened, 300 generic drug store to be opened

Education

Scheme to get Rs.500 cr for promoting entrepreneurship among SC/ST

10 public and 10 private educational institutions to be made world-class.

Digital repository for all school leaving certificates and diplomas. Rs. 1,000 crore for higher education financing.

Rs. 1,700 crore for 1500 multi-skill development centres.

62 new navodaya vidyalayas to provide quality education

Digital literacy scheme to be launched to cover 6 crore additional rural households

Entrepreneurship training to be provided across schools, colleges and massive online courses.

Objective to skill 1 crore youth in the next 3 years under the PM Kaushal Vikas Yojna-FM Jaitley

National Skill Development Mission has imparted training to 76 lakh youth. 1500 Multi-skill training institutes to be set up.

Energy

Rs. 3000 crore earmarked for nuclear power generation

Govt drawing comprehensive plan to be implemented in next 15-20 years for exploiting nuclear energy

Govt to provide incentive for deepwater gas exploration

Deepwater gas new disc to get calibrated market freedom, pre-determined ceiling price based on landed price of alternate fuels.

Investments and infrastructure

Rs. 27,000 crore to be spent on roadways

65 eligible habitats to be connected via 2.23 lakh kms of road. Current construction pace is 100 kms/day

Shops to be given option to remain open all seven days in a week across markets.

Rs. 55,000 crore for roads and highways. Total allocation for road construction, including PMGSY, – Rs 97,000 crore

India’s highest-ever production of motor vehicles was recorded in 2015

Total outlay for infrastructure in Budget 2016 now stands at Rs. 2,21,246 crore

New greenfield ports to be developed on east and west coasts

Revival of underserved airports. Centre to Partner with States to revive small airports for regional connectivity

100 per cent FDI in marketing of food products produced and marketed in India

Dept. of Disinvestment to be renamed as Dept. of Investment and Public Asset Management

Govt will amend Motor Vehicle Act in passenger vehicle segment to allow innovation.

MAT will be applicable for startups that qualify for 100 per cent tax exemption

Direct tax proposals result in revenue loss of Rs.1060 crore, indirect tax proposals result in gain of Rs.20,670 crore

Agriculture

Total allocation for agriculture and farmer welfare at Rs 35984 crores

28.5 lakh heactares of land wil be brought under irrigation.

5 lakh acres to be brought under organic farming over a three year period

Rs 60,000 crore for recharging of ground water recharging as there is urgent need to focus on drought hit areas cluster development for water conservation.

Dedicated irrigation fund in NABARD of Rs.20.000 cr

Nominal premium and highest ever compensation in case of crop loss under the PM Fasal Bima Yojna.

Banking

Banks get a big boost: Rs 25,000 crore towards recapitalisation of public sector banks. Jaitley says: Banking Board Bureau will be operationalised, we stand solidly behind public sector banks.

Target of disbursement under MUDRA increased to 1,80,000 crore

Process of transfer of government stake in IDBI Bank below 50% started

General Insurance companies will be listed in the stock exchange

Govt to increase ATMs, micro-ATMs in post offices in next three years

Hindu details