Priyanka Chopra announced Hottest Woman of 2015!

25 02 2015

Priyanka Chopra beats Deepika Padukone – announced Hottest Woman of 2015!

She’s hugely talented, intelligent, driven, multifaceted, risk-taker, socially conscious, adorable, beautiful, sassy and also very very Sexy…. It’s very difficult to describe Priyanka Chopra in one sentence. So when over 10 million people from across the world voted for her as the ‘World’s sexiest Asian Woman’, you cant help but nod your head in agreement.

The World';s Sexiest Asian Woman recently also bagged the spot for the “Hottest Women of 2015″ ,elbowing out contemporaries with a whopping 53% votes beating Deepika Padukone who received 35% of the votes.This isn';t the first time that the SHERO has beat Deepika at a poll – Priyanka topped the Sexiest Woman in a Bikini poll, bagging 22,552 votes out of the 23,775 votes that came in, winning by a huge margin.

One of Bollywood’s most sought after actresses and international recording artist Priyanka Chopra also made it to the Numero Uno spot on the Ultimate Guys Guide- Maxim India’s Hottest List for 2013.

This was the second consecutive year that Priyanka made it to the top rankings on the magazine’s Hottest List , an annual poll with some of the most gorgeous women competing for the crown.The “Exotic” singer and power player beat the likes of Grammy award winner Beyonce and Victoria’s Secret model Adriana Lima to the no#1 spot.

She’s hugely talented, intelligent, driven, multifaceted, risk-taker, socially conscious, adorable, beautiful, sassy and also very very Sexy…. It’s very difficult to describe Priyanka Chopra in one sentence. So when over 10 million people from across the world voted for her as the ‘World’s sexiest Asian Woman’, you cant help but nod your head in agreement.

The World';s Sexiest Asian Woman recently also bagged the spot for the “Hottest Women of 2015″ ,elbowing out contemporaries with a whopping 53% votes beating Deepika Padukone who received 35% of the votes.This isn';t the first time that the SHERO has beat Deepika at a poll – Priyanka topped the Sexiest Woman in a Bikini poll, bagging 22,552 votes out of the 23,775 votes that came in, winning by a huge margin.

One of Bollywood’s most sought after actresses and international recording artist Priyanka Chopra also made it to the Numero Uno spot on the Ultimate Guys Guide- Maxim India’s Hottest List for 2013.

This was the second consecutive year that Priyanka made it to the top rankings on the magazine’s Hottest List , an annual poll with some of the most gorgeous women competing for the crown.The “Exotic” singer and power player beat the likes of Grammy award winner Beyonce and Victoria’s Secret model Adriana Lima to the no#1 spot.

Edit : Edit

Comments : Leave a Comment »

Categories : Business, Entertainment

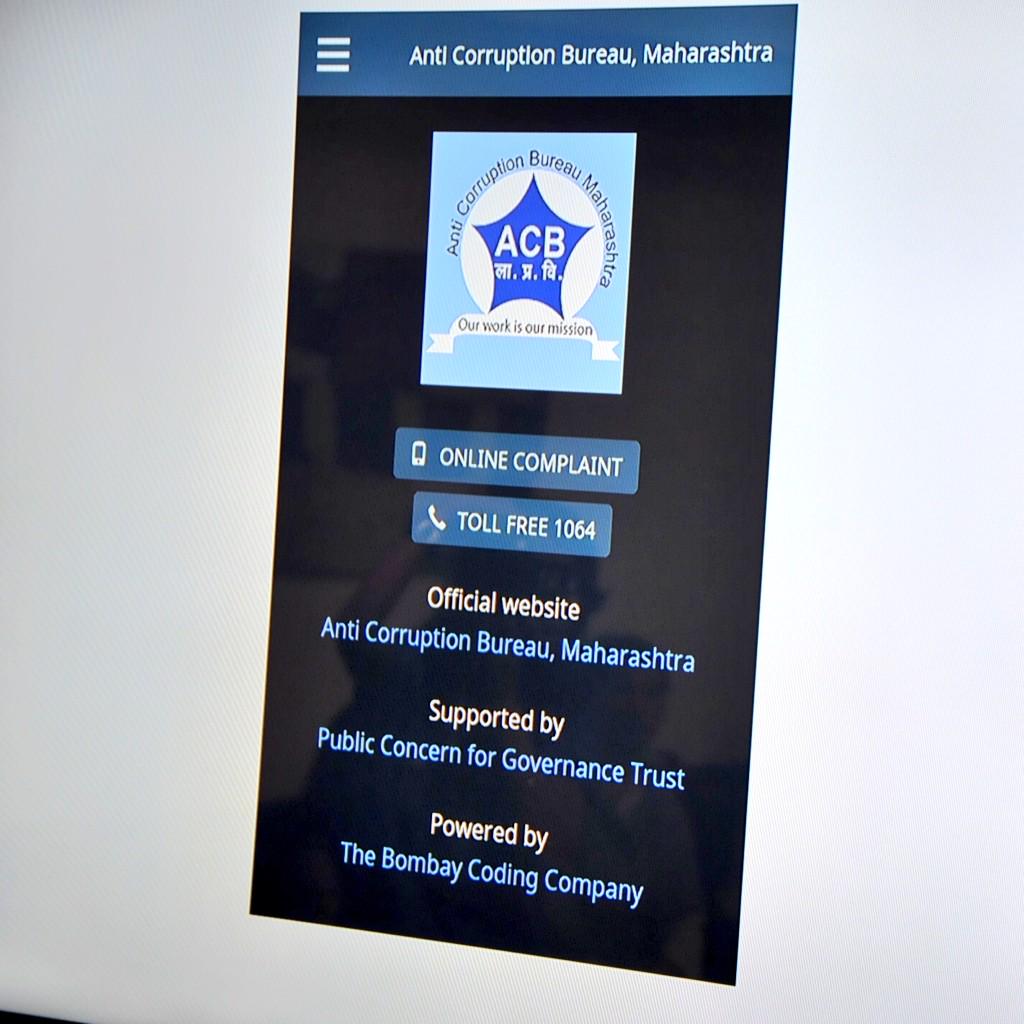

Launched aMobileApp forAnti-CorruptionBureau

25 02 2015

Launched aMobileApp developed by BombayCodingCompany forAnti-CorruptionBureau.Trained officer ready in every district

Edit : Edit

Comments : Leave a Comment »

Categories : Business

RBI smoothen guidelines for Securitisation or Reconstruction Companies in regards to substantial change in its management

25 02 2015

Every

Securitisation Company / Reconstruction Company (SC / RC) is required

to obtain prior approval of the Reserve Bank for any substantial change

in its management. In order to smoothen the functioning of SC/RC

companies, it has been decided by RBI, henceforth changes in the share

holding pattern of the SC/RC will require Reserve Bank’s prior approval

in cases such as any transfer of shares by which the transferee becomes a

sponsor, any transfer of shares by which the transferor ceases to be a

sponsor and an aggregate transfer of ten percent or more of the total

paid up share capital of the SC/RC by a sponsor during the period of

five years commencing from the date of certificate of registration.

|

In

terms of Section 3(6) of the SARFAESI Act, 2002, every Securitisation

Company / Reconstruction Company (SC / RC) is required to obtain prior

approval of the Reserve Bank for any substantial change in its

management. For the purpose of this section, the expression “substantial

change in management” means the change in the management by way of

transfer of shares or amalgamation or transfer of the business of the

company. Hence, one of the terms and conditions stipulated to the

SC/RCs, while granting them the Certificate of Registration, states that

prior approval of Reserve Bank will have to be taken by the SC/RCs for

any change in their shareholding pattern.

In

order to smoothen the functioning of SC/RC companies, it has been

decided that, henceforth only the following changes in the share holding

pattern of the SC/RC will require Reserve Bank’s prior approval:

· any transfer of shares by which the transferee becomes a sponsor.

· any transfer of shares by which the transferor ceases to be a sponsor.

· an

aggregate transfer of ten percent or more of the total paid up share

capital of the SC/RC by a sponsor during the period of five years

commencing from the date of certificate of registration.

|

Edit : Edit

Comments : Leave a Comment »

Categories : Finnance

Snapshot of the summary of report of Fourteenth Finance Commission

25 02 2015

The fourteenth Finance Commission has recommended substantial

hike in share of states in central taxes and asked them to tailor make

schemes as per their needs. The states share will now be 42% of the

entire amount as compared to 32% previously which will translate into an

additional, estimated Rs 1.78 lakh crore in the next fiscal year.

The snapshot of the report is as follows-

Sharing of Union Taxes

1. Considering all factors, the commission believes that increasing the share of tax devolution to 42 % of the divisible pool would serve the twin objectives of increasing the flow of unconditional transfers to the States and yet leave appropriate fiscal space for the Union to carry out specific purpose transfers to the States.

2. For area the Commission has adopted the method used by the FC-XII and put the floor limit at 2% for smaller States and assigned 15% weight.

3. In Commission’s view the large forest cover provides huge ecological benefits, but there is also an opportunity cost in terms of area not available for other economic activities and this also serves as an important indicator of fiscal disability. We have assigned 7.5% weight to the forest cover.

4. As service tax is not levied in the State of Jammu & Kashmir, proceeds cannot be assigned to this State.

5. The commission has decided to revert to the method of representing fiscal capacity in terms of income distance and assigned it 50% weight.

Disaster Management

1. The Commission has recommended that the Union Government consider ensuring an assured source of funding for the NDRF and the past trends of out flows from it should be taken into account by the Union Government to ensure adequacy of the Fund in order to assure timely availability and release of funds to the States.

2. A decision on granting tax exemption to private contributions to the NDRF be expedited and that the Union Government consider invoking the use of Schedule VII of the Companies (Corporate Social Responsibility Policy) Rules 2014 as an enabling provision for financing the NDRF.

3. A review of the current arrangements for the reimbursement of expenditure incurred by the defence forces on disaster relief is also recommended.

4. Expediting the development and scientific validation of the Hazard Vulnerability Risk Profiles of States is also recommended by the commission to the union budget.

5. All States should contribute 10 % to SDRF during the award period of the Finance Commission with the remaining 90 % coming from the Union Government.

6. Union Government is also recommended to take account of the genuine concerns of the States in the consultative mechanism already in place.

7. Considering the need for flexibility in regard to state-specific disasters, it is recommended that up to 10 % of the funds available under the SDRF can be used by State Governments for natural disasters that they consider to be ‘disasters’ within the local context in the State and which are not included in the notified list of disasters of the Ministry of Home Affairs.

Grants-in-Aid

1. A total revenue deficit grant of Rs. 1, 94,821 crore is recommended during the award period for eleven States.

2. There is a case for transfers from the Union Government to the States to augment expenditure in specific sectors with high degree of externalities in order to ensure desired minimum level of expenditures in every State. However, past experience shows that achieving this through the mechanism of Finance Commission grants may not be appropriate.

3. The proposal made by the Department of Justice to strengthen the judicial systems in the States is also endorsed and State Governments are urged to use the additional fiscal space provided by us in the tax devolution to meet such requirements.

4. The expenditure needs of the States has taken into account the high base of expenditure for both general administration and police. Therefore, the States have the appropriate fiscal space to provide for the additional expenditure needs as per their requirements.

5. Appropriate fiscal space for maintenance expenditures is provided to the states which would enable them to meet the additional expenditure needs according to their requirements. The States are also recommended to enhance expenditure on maintenance of capital assets to the appropriate levels.

6. Health, education, drinking water and sanitation are considered as public services of national importance, having significant inter-state externalities. Therefore, it is desisted from recommending specific purpose grants and have suggested that a separate institutional arrangement be introduced for the purpose.

Towards Cooperative Federalism

1. It is concluded that a compelling case has been made for reforming the existing system of fiscal transfers from the Union to the States, in a comprehensive manner. Hence it is recommended that the existing system be reviewed and necessary institutional changes be considered.

2. The commission believes the existing arrangements for transfers between the Union and the States needs to be reviewed with a view to minimizing discretion, improving the design of transfers, avoiding duplication and promoting cooperative federalism, insofar as such transfers are required to be made outside of the recommendations of the Finance Commission.

3. It is also recommended that the suggested new institutional arrangement also consider taking up issues related to identifying and recommending resources for inter-state infrastructure schemes in the North-eastern States.

4. The new institutional arrangement should also become the forum for integrating economic and environmental concerns in decision making.

Goods and Services Tax

1. The Union may have to initially bear an additional fiscal burden arising due to the GST compensation. This fiscal burden should be treated as an investment which is certain to yield substantial gains to the nation in the medium and long run. The Commission believes that GST compensation can be accommodated in the overall fiscal space available with the Union Government.

2. In the case of VAT, compensation was provided to the States for three years, at 100 % in the first year, 75 % in the second year, and 50 per cent in the third year. However, given the scale of reform and the apprehensions of revenue uncertainty raised by the States, the revenue compensation should be for five years. It is suggested that 100%compensation be paid to the States in the first, second and third years, 75 % compensation in the fourth year and 50 per cent compensation in the fifth and final year.

3. The creation of an autonomous and independent GST Compensation Fund through legislative actions in a manner that it gives reasonable comfort to States is recommended such that it limits the period of operation appropriately.

4. The Constitutional legislative and design aspects of the GST is recommended enabling the transition towards universal application of GST over the medium to long term.

Public Expenditure Management

1. The Commission endorse the view that the transition to accrual-based accounting by both the Union and State Governments is desirable.

2. At the Object Head level, the commission believes it is sufficient to have a few uniform Object Heads, such as salary, maintenance, subsidies and grants-in aid, across both the Union and States. Regarding the other Object Heads, States are recommend to retain their existing flexibility to open new Object Heads according to their functional requirements.

3. The formulation of appropriate indicators for the measurement of outputs, specification of standards and costs and establishing a suitable accountability framework is recommended.

4. It is suggested that serious consideration of the issue of assigning primary responsibility for preparing outcome budgets at the level of actual spending and its consolidation at the relevant level of government.

5. The Union and State Governments are asked to consider the recommendations of the Second Administrative Reforms Commission (submitted in 2009) on internal audit and internal control systems, and take a decision on each recommendation expeditiously.

6. The views of the FC-XI are reiterated for a consultative mechanism between the Union and States, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments.

7. The commission also recommends the linking of pay with productivity, with a simultaneous focus on technology, skill and incentives. We recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’, with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions. It is urged that, in future, additional remuneration be linked to increase in productivity.

8. The New Pension Scheme to be adopted by the states is recommended.

Public Sector Enterprises

1. The Commission recommends that the new realities be considered in evaluating the future of each public enterprise in the entire portfolio of Central public sector enterprises.

2. The evaluation of the fiscal implications of the current level of investments in, and operations of, the existing public enterprises, in terms of opportunity costs, is an essential ingredient of credible fiscal consolidation. Hence, the fiscal implications in terms of opportunity costs be factored in while evaluating the desirable level of government ownership for each public enterprise in the entire portfolio of Central public sector enterprises is recommended.

3. The Commission recommends that the basic interests of workers of Central public sector enterprises should be protected at a reasonable fiscal cost, while ensuring a smooth process of disinvestment or relinquishing of individual enterprises. We further recommend that employment objectives should be considered in evaluating the portfolio of public enterprises, not only in the narrow context of the enterprises’ employees, but also in terms of creating new employment opportunities.

4. The Commission recommends that the route of transparent auctions be adopted for the relinquishment of unlisted sick enterprises in the category of non-priority public sector enterprises.

5. The Commission recommends that the level of disinvestment should be derived from the level of investment that the government decides to hold over the medium to long term in each enterprise, based on principles of prioritization advised by us, while the process of disinvestment should take into account the market conditions and budgetary requirements, on a year to year basis.

6. The Commission recommends that the government devise a policy relating to the new areas of public sector investments. We also recommend the purchase of shares where the existing portfolio holding.

7. The Commission recommends that the enterprises be categorized into ‘high priority’, ‘priority’, ‘low priority’ and ‘non-priority’ in order to: (i) facilitate co-ordinated follow-up action by policy makers and (ii) provide clarity to public enterprises themselves on their future and to the financial markets about the opportunities ahead for them.

8. The Commission recommends the recommendations made by the FC-XIII to maintain all disinvestment receipts in the Consolidated Fund for utilisation on capital expenditure. The National Investment Fund in the Public Account should, therefore, be wound up in consultation with the Controller General of Accounts (CGA) and Comptroller & Auditor General (C&AG).

9. The Commission recommends the recommendations made by the FC-XIII to maintain all disinvestment receipts in the Consolidated Fund for utilisation on capital expenditure. The National Investment Fund in the Public Account should, therefore, be wound up in consultation with the Controller General of Accounts (CGA) and Comptroller & Auditor General (C&AG).

10. There is considerable merit in the Union Government dispensing a small share of proceeds of disinvestment to the States. In the case of Central public sector enterprises with multiple units located in different states, the distribution of this share could be uniform across all the States where units are located. In cases where only vertical unit-wise disinvestment is done, the share could go to the State/States where the units being disinvested are located.

11. The importance of making Central public sector enterprises effective and competitive is recognized by the commission and the monitoring and evaluation of these enterprises is suggested to be taken into account the institutional constraints within which their managements operate. If the Central public sector enterprises are burdened with implementing social objectives of the government, it should compensate them in a timely manner and adequately through a transparent budgetary subvention. Similarly, losses on account of administered price mechanisms should also be calculated and fully compensated for

12. The Commission recommends that governance arrangements be reviewed, especially in regard to separation of regulatory functions from ownership, role of the nominee as well as independent Directors, and, above all, the framework of governance conducive to efficiency. The Commission recommends that as part of the comprehensive review of the public sector enterprises proposed by us, policies and procedures relating to borrowing by the enterprises, payment of dividends and transfer of excess reserves be enunciated and enforced.

Pricing of Public Utilities

1. In order to provide financial autonomy to the SERCs, Section 103 of the Electricity Act, 2003, provides for the establishment of a State Electricity Regulatory Commission Fund by State Governments, to enable the SERCs to perform their responsibilities, as envisaged under the Act.

2. The Commission recommends that accounting systems in the State Road Transport Undertakings make explicit the types of subsidies, the basis for determining the extent of subsidies, and also the extent of reimbursement by State Governments.

3. The Commission recommends the setting up of independent regulators for the passenger road sector, whose key functions should include tariff setting, regulation of service quality, assessment of concessionaire claims, collection and dissemination of sector information, service-level benchmarks and monitoring compliance of concession agreements.

4. The Commission recommends that all States, irrespective of whether Water Regulatory Authorities (WRAs) are in place or not, consider full volumetric measurement of the use of irrigation water. Any investment that may be required to meet this goal should be borne by the States, as the future cumulative benefits, both in environmental and economic terms, will far exceed the initial costs.

5. The Commission has reiterated the recommendations of the FC-XIII and urge States which have not set up WRAs to consider setting up a statutory WRA, so that the pricing of water for domestic, irrigation and other uses can be determined independently and in a judicious manner. However, this may not be practical for the North-eastern states, due to the small size of their irrigation sectors, with Assam being the exception.

6. The Commission recommends that States (and urban and rural bodies) should progressively move towards 100% metering of individual drinking water connections to households, commercial establishments as well as institutions. All existing individual connections in urban and rural areas should be metered by March 2017 and the cost of this should be borne by the consumers. All new connections should be given only when the functioning meters are installed. While providing protected water supply through community taps is unavoidable for poorer sections of population, metering of water consumed in such cases also would ensure efficient supply.

Fiscal Environment and Fiscal Consolidation Roadmap

1. The commission recommends that both Union and State Governments adopt a template for collating, analysing and annually reporting the total extended public debt in their respective budgets as a supplement to the budget document.

2. The Committee recommended that the Union and the State Governments provide a statutory ceiling on the sanction of new capital works to an appropriate multiple of the annual budget provision.

3. The fiscal deficit targets and annual borrowing limits for the States during the Finance Commission’s award period are enunciated as follows:

i. Fiscal deficit of all States will be anchored to an annual limit of 3% of GSDP. The States will be eligible for flexibility of 0.25% over and above this for any given year for which the borrowing limits are to be fixed if their debt-GSDP ratio is less than or equal to 25% in the preceding year.

ii. States will be further eligible for an additional borrowing limit of 0.25% of GSDP in a given year for which the borrowing limits are to be fixed if the interest payments are less than or equal to 10% of the revenue receipts in the preceding year.

iii. The two options under these flexibility provisions can be availed of by a State either separately, if any of the above criteria is fulfilled, or simultaneously if both the above stated criteria are fulfilled. Thus, a State can have a maximum fiscal deficit-GSDP limit of 3.5% in any given year.

4. The flexibility in availing the additional limit under either of the two options or both will be available to a State only if there is no revenue deficit in the year in which borrowing limits are to be fixed and the immediately preceding year. If a State is not able to fully utilise its sanctioned borrowing limit of 3 per cent of GSDP in any particular year during the first four years of our award period (2015-16 to 2018-19), it will have the option of availing this un-utilised borrowing amount (calculated in rupees) only in the following year but within our award period.

5. Recognising that the fiscal environment should be conducive to equitable growth, the Commission also recommends that the Union and all the States should target improving the quality of fiscal management encompassing receipts and expenditures while adhering to the roadmap we have outlined.

6. To enable wider dissemination of the manner in which this shared responsibility for a conducive fiscal environment is being discharged by the Union and State Governments, the Commission recommends that the Union Government and the RBI bring out a bi-annual report on the public debt of the Union and State Governments on a regular and comparable basis and place it in public domain.

7. The Commission recommends that the Union Government should consider making an amendment to the FRBM Act to omit the definition of effective revenue deficit from 1 April 2015. It also recommends that the objective of balancing revenues and expenditure on the revenue account enunciated in the FRBM Acts should be pursued.

8. The Commission recommends an amendment to the FRBM Act inserting a new section mandating the establishment of an independent fiscal council to undertake ex-ante assessment of the fiscal policy implications of budget proposals and their consistency with fiscal policy and Rules. In addition, we urge that the Union Government take expeditious action to bring into effect Section 7A of the FRBM Act for the purposes of ex-post assessment.

9. The approach outlined and recommendations made warrant amendments to the FRBM Acts. To this end, the State Governments are suggested to may their FRBM Acts to provide for the statutory flexible limits on fiscal deficit. The Union Government may amend its FRBM Act to reflect the fiscal roadmap, omit the definition of effective revenue deficit and mandate the establishment of an independent fiscal council. Further, the Union and State Governments may also amend their respective FRBM Acts to provide a statutory ceiling on the sanction of new capital works to an appropriate multiple of the annual budget provision.

Local Governments

1. The Commission recommends that the local bodies should be required to spend the grants only on the basic services within the functions assigned to them under relevant legislations.

2. The Commission recommends that the books of accounts prepared by the local bodies should distinctly capture income on account of own taxes and non-taxes, assigned taxes, devolution and grants from the State, grants from the Finance Commission and grants for any agency functions assigned by the Union and State Governments. In addition to the above, we also recommend that the technical guidance and support arrangements by the C&AG should be continued and the States should take action to facilitate local bodies to compile accounts and have them audited in time.

3. The Commission recommends distribution of grants to the States using 2011 population data with weight of 90% and area with weight of 10%. The grant to each state will be divided into two, a grant to duly constituted gram panchayats and a grant to duly constituted municipalities, on the basis of urban and rural population of that state using the data of census 2011.

The snapshot of the report is as follows-

Sharing of Union Taxes

1. Considering all factors, the commission believes that increasing the share of tax devolution to 42 % of the divisible pool would serve the twin objectives of increasing the flow of unconditional transfers to the States and yet leave appropriate fiscal space for the Union to carry out specific purpose transfers to the States.

2. For area the Commission has adopted the method used by the FC-XII and put the floor limit at 2% for smaller States and assigned 15% weight.

3. In Commission’s view the large forest cover provides huge ecological benefits, but there is also an opportunity cost in terms of area not available for other economic activities and this also serves as an important indicator of fiscal disability. We have assigned 7.5% weight to the forest cover.

4. As service tax is not levied in the State of Jammu & Kashmir, proceeds cannot be assigned to this State.

5. The commission has decided to revert to the method of representing fiscal capacity in terms of income distance and assigned it 50% weight.

Disaster Management

1. The Commission has recommended that the Union Government consider ensuring an assured source of funding for the NDRF and the past trends of out flows from it should be taken into account by the Union Government to ensure adequacy of the Fund in order to assure timely availability and release of funds to the States.

2. A decision on granting tax exemption to private contributions to the NDRF be expedited and that the Union Government consider invoking the use of Schedule VII of the Companies (Corporate Social Responsibility Policy) Rules 2014 as an enabling provision for financing the NDRF.

3. A review of the current arrangements for the reimbursement of expenditure incurred by the defence forces on disaster relief is also recommended.

4. Expediting the development and scientific validation of the Hazard Vulnerability Risk Profiles of States is also recommended by the commission to the union budget.

5. All States should contribute 10 % to SDRF during the award period of the Finance Commission with the remaining 90 % coming from the Union Government.

6. Union Government is also recommended to take account of the genuine concerns of the States in the consultative mechanism already in place.

7. Considering the need for flexibility in regard to state-specific disasters, it is recommended that up to 10 % of the funds available under the SDRF can be used by State Governments for natural disasters that they consider to be ‘disasters’ within the local context in the State and which are not included in the notified list of disasters of the Ministry of Home Affairs.

Grants-in-Aid

1. A total revenue deficit grant of Rs. 1, 94,821 crore is recommended during the award period for eleven States.

2. There is a case for transfers from the Union Government to the States to augment expenditure in specific sectors with high degree of externalities in order to ensure desired minimum level of expenditures in every State. However, past experience shows that achieving this through the mechanism of Finance Commission grants may not be appropriate.

3. The proposal made by the Department of Justice to strengthen the judicial systems in the States is also endorsed and State Governments are urged to use the additional fiscal space provided by us in the tax devolution to meet such requirements.

4. The expenditure needs of the States has taken into account the high base of expenditure for both general administration and police. Therefore, the States have the appropriate fiscal space to provide for the additional expenditure needs as per their requirements.

5. Appropriate fiscal space for maintenance expenditures is provided to the states which would enable them to meet the additional expenditure needs according to their requirements. The States are also recommended to enhance expenditure on maintenance of capital assets to the appropriate levels.

6. Health, education, drinking water and sanitation are considered as public services of national importance, having significant inter-state externalities. Therefore, it is desisted from recommending specific purpose grants and have suggested that a separate institutional arrangement be introduced for the purpose.

Towards Cooperative Federalism

1. It is concluded that a compelling case has been made for reforming the existing system of fiscal transfers from the Union to the States, in a comprehensive manner. Hence it is recommended that the existing system be reviewed and necessary institutional changes be considered.

2. The commission believes the existing arrangements for transfers between the Union and the States needs to be reviewed with a view to minimizing discretion, improving the design of transfers, avoiding duplication and promoting cooperative federalism, insofar as such transfers are required to be made outside of the recommendations of the Finance Commission.

3. It is also recommended that the suggested new institutional arrangement also consider taking up issues related to identifying and recommending resources for inter-state infrastructure schemes in the North-eastern States.

4. The new institutional arrangement should also become the forum for integrating economic and environmental concerns in decision making.

Goods and Services Tax

1. The Union may have to initially bear an additional fiscal burden arising due to the GST compensation. This fiscal burden should be treated as an investment which is certain to yield substantial gains to the nation in the medium and long run. The Commission believes that GST compensation can be accommodated in the overall fiscal space available with the Union Government.

2. In the case of VAT, compensation was provided to the States for three years, at 100 % in the first year, 75 % in the second year, and 50 per cent in the third year. However, given the scale of reform and the apprehensions of revenue uncertainty raised by the States, the revenue compensation should be for five years. It is suggested that 100%compensation be paid to the States in the first, second and third years, 75 % compensation in the fourth year and 50 per cent compensation in the fifth and final year.

3. The creation of an autonomous and independent GST Compensation Fund through legislative actions in a manner that it gives reasonable comfort to States is recommended such that it limits the period of operation appropriately.

4. The Constitutional legislative and design aspects of the GST is recommended enabling the transition towards universal application of GST over the medium to long term.

Public Expenditure Management

1. The Commission endorse the view that the transition to accrual-based accounting by both the Union and State Governments is desirable.

2. At the Object Head level, the commission believes it is sufficient to have a few uniform Object Heads, such as salary, maintenance, subsidies and grants-in aid, across both the Union and States. Regarding the other Object Heads, States are recommend to retain their existing flexibility to open new Object Heads according to their functional requirements.

3. The formulation of appropriate indicators for the measurement of outputs, specification of standards and costs and establishing a suitable accountability framework is recommended.

4. It is suggested that serious consideration of the issue of assigning primary responsibility for preparing outcome budgets at the level of actual spending and its consolidation at the relevant level of government.

5. The Union and State Governments are asked to consider the recommendations of the Second Administrative Reforms Commission (submitted in 2009) on internal audit and internal control systems, and take a decision on each recommendation expeditiously.

6. The views of the FC-XI are reiterated for a consultative mechanism between the Union and States, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments.

7. The commission also recommends the linking of pay with productivity, with a simultaneous focus on technology, skill and incentives. We recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’, with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions. It is urged that, in future, additional remuneration be linked to increase in productivity.

8. The New Pension Scheme to be adopted by the states is recommended.

Public Sector Enterprises

1. The Commission recommends that the new realities be considered in evaluating the future of each public enterprise in the entire portfolio of Central public sector enterprises.

2. The evaluation of the fiscal implications of the current level of investments in, and operations of, the existing public enterprises, in terms of opportunity costs, is an essential ingredient of credible fiscal consolidation. Hence, the fiscal implications in terms of opportunity costs be factored in while evaluating the desirable level of government ownership for each public enterprise in the entire portfolio of Central public sector enterprises is recommended.

3. The Commission recommends that the basic interests of workers of Central public sector enterprises should be protected at a reasonable fiscal cost, while ensuring a smooth process of disinvestment or relinquishing of individual enterprises. We further recommend that employment objectives should be considered in evaluating the portfolio of public enterprises, not only in the narrow context of the enterprises’ employees, but also in terms of creating new employment opportunities.

4. The Commission recommends that the route of transparent auctions be adopted for the relinquishment of unlisted sick enterprises in the category of non-priority public sector enterprises.

5. The Commission recommends that the level of disinvestment should be derived from the level of investment that the government decides to hold over the medium to long term in each enterprise, based on principles of prioritization advised by us, while the process of disinvestment should take into account the market conditions and budgetary requirements, on a year to year basis.

6. The Commission recommends that the government devise a policy relating to the new areas of public sector investments. We also recommend the purchase of shares where the existing portfolio holding.

7. The Commission recommends that the enterprises be categorized into ‘high priority’, ‘priority’, ‘low priority’ and ‘non-priority’ in order to: (i) facilitate co-ordinated follow-up action by policy makers and (ii) provide clarity to public enterprises themselves on their future and to the financial markets about the opportunities ahead for them.

8. The Commission recommends the recommendations made by the FC-XIII to maintain all disinvestment receipts in the Consolidated Fund for utilisation on capital expenditure. The National Investment Fund in the Public Account should, therefore, be wound up in consultation with the Controller General of Accounts (CGA) and Comptroller & Auditor General (C&AG).

9. The Commission recommends the recommendations made by the FC-XIII to maintain all disinvestment receipts in the Consolidated Fund for utilisation on capital expenditure. The National Investment Fund in the Public Account should, therefore, be wound up in consultation with the Controller General of Accounts (CGA) and Comptroller & Auditor General (C&AG).

10. There is considerable merit in the Union Government dispensing a small share of proceeds of disinvestment to the States. In the case of Central public sector enterprises with multiple units located in different states, the distribution of this share could be uniform across all the States where units are located. In cases where only vertical unit-wise disinvestment is done, the share could go to the State/States where the units being disinvested are located.

11. The importance of making Central public sector enterprises effective and competitive is recognized by the commission and the monitoring and evaluation of these enterprises is suggested to be taken into account the institutional constraints within which their managements operate. If the Central public sector enterprises are burdened with implementing social objectives of the government, it should compensate them in a timely manner and adequately through a transparent budgetary subvention. Similarly, losses on account of administered price mechanisms should also be calculated and fully compensated for

12. The Commission recommends that governance arrangements be reviewed, especially in regard to separation of regulatory functions from ownership, role of the nominee as well as independent Directors, and, above all, the framework of governance conducive to efficiency. The Commission recommends that as part of the comprehensive review of the public sector enterprises proposed by us, policies and procedures relating to borrowing by the enterprises, payment of dividends and transfer of excess reserves be enunciated and enforced.

Pricing of Public Utilities

1. In order to provide financial autonomy to the SERCs, Section 103 of the Electricity Act, 2003, provides for the establishment of a State Electricity Regulatory Commission Fund by State Governments, to enable the SERCs to perform their responsibilities, as envisaged under the Act.

2. The Commission recommends that accounting systems in the State Road Transport Undertakings make explicit the types of subsidies, the basis for determining the extent of subsidies, and also the extent of reimbursement by State Governments.

3. The Commission recommends the setting up of independent regulators for the passenger road sector, whose key functions should include tariff setting, regulation of service quality, assessment of concessionaire claims, collection and dissemination of sector information, service-level benchmarks and monitoring compliance of concession agreements.

4. The Commission recommends that all States, irrespective of whether Water Regulatory Authorities (WRAs) are in place or not, consider full volumetric measurement of the use of irrigation water. Any investment that may be required to meet this goal should be borne by the States, as the future cumulative benefits, both in environmental and economic terms, will far exceed the initial costs.

5. The Commission has reiterated the recommendations of the FC-XIII and urge States which have not set up WRAs to consider setting up a statutory WRA, so that the pricing of water for domestic, irrigation and other uses can be determined independently and in a judicious manner. However, this may not be practical for the North-eastern states, due to the small size of their irrigation sectors, with Assam being the exception.

6. The Commission recommends that States (and urban and rural bodies) should progressively move towards 100% metering of individual drinking water connections to households, commercial establishments as well as institutions. All existing individual connections in urban and rural areas should be metered by March 2017 and the cost of this should be borne by the consumers. All new connections should be given only when the functioning meters are installed. While providing protected water supply through community taps is unavoidable for poorer sections of population, metering of water consumed in such cases also would ensure efficient supply.

Fiscal Environment and Fiscal Consolidation Roadmap

1. The commission recommends that both Union and State Governments adopt a template for collating, analysing and annually reporting the total extended public debt in their respective budgets as a supplement to the budget document.

2. The Committee recommended that the Union and the State Governments provide a statutory ceiling on the sanction of new capital works to an appropriate multiple of the annual budget provision.

3. The fiscal deficit targets and annual borrowing limits for the States during the Finance Commission’s award period are enunciated as follows:

i. Fiscal deficit of all States will be anchored to an annual limit of 3% of GSDP. The States will be eligible for flexibility of 0.25% over and above this for any given year for which the borrowing limits are to be fixed if their debt-GSDP ratio is less than or equal to 25% in the preceding year.

ii. States will be further eligible for an additional borrowing limit of 0.25% of GSDP in a given year for which the borrowing limits are to be fixed if the interest payments are less than or equal to 10% of the revenue receipts in the preceding year.

iii. The two options under these flexibility provisions can be availed of by a State either separately, if any of the above criteria is fulfilled, or simultaneously if both the above stated criteria are fulfilled. Thus, a State can have a maximum fiscal deficit-GSDP limit of 3.5% in any given year.

4. The flexibility in availing the additional limit under either of the two options or both will be available to a State only if there is no revenue deficit in the year in which borrowing limits are to be fixed and the immediately preceding year. If a State is not able to fully utilise its sanctioned borrowing limit of 3 per cent of GSDP in any particular year during the first four years of our award period (2015-16 to 2018-19), it will have the option of availing this un-utilised borrowing amount (calculated in rupees) only in the following year but within our award period.

5. Recognising that the fiscal environment should be conducive to equitable growth, the Commission also recommends that the Union and all the States should target improving the quality of fiscal management encompassing receipts and expenditures while adhering to the roadmap we have outlined.

6. To enable wider dissemination of the manner in which this shared responsibility for a conducive fiscal environment is being discharged by the Union and State Governments, the Commission recommends that the Union Government and the RBI bring out a bi-annual report on the public debt of the Union and State Governments on a regular and comparable basis and place it in public domain.

7. The Commission recommends that the Union Government should consider making an amendment to the FRBM Act to omit the definition of effective revenue deficit from 1 April 2015. It also recommends that the objective of balancing revenues and expenditure on the revenue account enunciated in the FRBM Acts should be pursued.

8. The Commission recommends an amendment to the FRBM Act inserting a new section mandating the establishment of an independent fiscal council to undertake ex-ante assessment of the fiscal policy implications of budget proposals and their consistency with fiscal policy and Rules. In addition, we urge that the Union Government take expeditious action to bring into effect Section 7A of the FRBM Act for the purposes of ex-post assessment.

9. The approach outlined and recommendations made warrant amendments to the FRBM Acts. To this end, the State Governments are suggested to may their FRBM Acts to provide for the statutory flexible limits on fiscal deficit. The Union Government may amend its FRBM Act to reflect the fiscal roadmap, omit the definition of effective revenue deficit and mandate the establishment of an independent fiscal council. Further, the Union and State Governments may also amend their respective FRBM Acts to provide a statutory ceiling on the sanction of new capital works to an appropriate multiple of the annual budget provision.

Local Governments

1. The Commission recommends that the local bodies should be required to spend the grants only on the basic services within the functions assigned to them under relevant legislations.

2. The Commission recommends that the books of accounts prepared by the local bodies should distinctly capture income on account of own taxes and non-taxes, assigned taxes, devolution and grants from the State, grants from the Finance Commission and grants for any agency functions assigned by the Union and State Governments. In addition to the above, we also recommend that the technical guidance and support arrangements by the C&AG should be continued and the States should take action to facilitate local bodies to compile accounts and have them audited in time.

3. The Commission recommends distribution of grants to the States using 2011 population data with weight of 90% and area with weight of 10%. The grant to each state will be divided into two, a grant to duly constituted gram panchayats and a grant to duly constituted municipalities, on the basis of urban and rural population of that state using the data of census 2011.

Edit : Edit

Comments : Leave a Comment »

Categories : Finnance

Cheok Huei Shian as Chief Financial Officer of AIRASIA

25 02 2015

AirAsia X appoints Cheok Huei Shian as Chief Financial Officer

SEPANG, 25th February 2015- AirAsia X Berhad, the leading long-haul low-fare carrier today announced the appointment of Cheok Huei Shian as

its Chief Financial Officer effective immediately. Reporting directly

to Benyamin Ismail, acting Chief Executive Officer of AirAsia X Berhad,

Huei Shian will be responsible for corporate finance, treasury,

financial planning and analysis as well as investor relations.

Datuk Kamarudin Meranun, Group CEO of AirAsia X said,

“We are excited to have Huei Shian join our management team as we

continue to drive our strategic and financial business transformation.

Huei Shian was part of the core team in the early days of AirAsia and

has played an instrumental role in the success of AirAsia and getting

the company listed on the Bursa Stock Exchange. She has vast experience

and been involved in the turnaround team that oversees the entire

AirAsia group. Her strong track record of financial and operational

management success, combined with her very intimate knowledge of

AirAsia’s business model, culture and products, make her exceptionally

qualified to help us continue to build upon our market. My vision is to

bring back people that understands the business as it will be

instrumental in realizing our goal to be the undisputed global leader in

the long-haul LCC category.”

Huei

Shian joined AirAsia in 2004 and has held senior leadership roles

across the group. Prior to AirAsia, Huei Shian was with Ernst &

Young in the Financial and Advisory Service Department.

Huei Shian holds an Association of Chartered Certified Accountants (ACCA) Professional

Stage from FTMS Business School and an ACCA Certificate from University

Tunku Abdul Rahman (UTAR), Kuala Lumpur. Huei Shian is a fellow member

of the ACCA (Association of Chartered Certified Accountants) and a

member of the MIA (Malaysia Institute of Accountants).

Benyamin

Ismail, acting CEO of AirAsia X Berhad said, “We are delighted to have

Huei Shian in the team. We now have the right people in key management

positions and an organization that is optimally structured to support

our current business, company growth and the successful execution of key

new initiatives.”

Huei Shian

replaces Chew Eng Loke, the former Chief Financial Officer of AirAsia X,

who has decided to pursue other opportunities.

Edit : Edit

Comments : Leave a Comment »

Categories : Uncategorized

Anti Corruption activist, Anna Hazare led a two day protest

25 02 2015

Anti Corruption activist, Shri

Anna Hazare led a two day protest for farmer rights at Jantar Mantar,on

23 and 24 of February, 2015. The protest grounds were a striking

contrast with his previous protest in 2011. In 2011, there was a crowd

teeming with anger, energy and hope. In 2015 , there was a crowd with

little hope and more discipline than could be seen in 2011. The dominant

sensation was of fear. Fear of eviction from the land on which they

had lived for generations together , was the motivating factor, which

had drawn crowds from various parts of the country. All the oppositions

parties , have declared their support for the cause of the farmers. The

Delhi Chief Minister, Shri Arvind Kejriwal, of the Aam Aadmi, also

shared the stage with Shri Anna Hazare on 24 February, 2015. Using this

opportunity Shri Kejriwal , said that “In the country, if any government

makes laws against the poor, makes laws against the farmers, the public

will not let it last. They will teach them a lesson.”When asked , the

protestors said that they believed that after the said bill becomes a

law, their land will be forcibly taken and given to the “rich

industrialists”. The fact that land is also acquired by the government

for developmental activities, did not find much resonance among them.

Some of them also voiced concern about the government machinery being

inefficient and corrupt, would thus deprive them of the compensation or

delay it inconveniently. The removal of the Social Impact Assessment

and the Consent clause are the two major points of contention, between

the government and the opposition. Though the lesser covered fact is

that, both these clauses have been removed only for land acquisition

under five sectors, which are – national security, defence, rural

infrastructure , industrial corridors and housing for the poor. The

Finance Minister, Shri Arun Jaitely , also stated that the removal of

the two clauses was done with the concurrence of the states, including

the opposition ruled ones.The Jantar Mantar was probably exactly

opposite of the gathering inside both the houses of the Parliament. The

people at the Jantar Mantar echoed the sentiment of not being heard.

They were from different places, and the only thing that bound them was

their desire to be heard by the government. While inside, the people

weren’t too keen on debate or discussion. They seemed keen to obstruct.

While the opposition from the people came essentially on the content of

the the Bill, the lawmakers also opposed the Ordinance route adopted by

the government. In the meanwhile, the government reiterated it’s

commitment to having a constructive debate on the issue and also

appointed a committee under the leadership of, BJP president, Mr. Amit

Shah to look into the suggestions of the farmers.The farmers’ desire to

be heard maybe taken care of, by the committee, what remains to be seen

is how the lawmakers of the country will react, when the Land

Acquisition Bill is tabled in the Parliament. The nation awaits!

Aparna Pande

apande94@yahoo.in

On electric water tariff Arvind Kejriwal government

in Delhi on Wednesday slashed power tariff by half for 400 Units the

lower slab users and announced free water up to 20,000 litres for every

household from March 1.

apande94@yahoo.in

No comments:

Post a Comment